A story is recently making the rounds on Yahoo! Finance regarding "new" collection agency tactics that focus on "customer service" and "friendliness."

According to reports published by the Association of Credit and Collection Professionals International (ACAI), the debt collection industry took in approximately $52 billion in revenue in 2013, compared $55 billion in 2010. That is "billions" with a "B:" i.e., a whole lot of money.

Though the industry may be attempting to rebrand itself based on a new-found commitment to "customer service," it is important to remember that debt collectors have one ultimate objective in mind: to get money from consumers.

Regardless of how friendly the letters may be, or how nice someone may speak to a consumer on the phone, debt collectors may still be hurting a person's credit, and they may be preparing to file a lawsuit against them. Moreover, if they choose not to sue, they may decide to sell the debt off to another collector who may not care so much about "friendliness."

Consumers would do well to remember that debt collectors are still required to play by the rules provided by the FDCPA, including: warning you that they are a debt collector attempting to collect a debt; debt validation letters; and refraining from unfair or abusive behavior. If a debt collector fails to do these things, even if they have a smile on their face, it is still a violation of the law.

A blog provided by Noah R. Friend Law Firm, PLLC to provide general information and updates regarding FDCPA issues. We represent consumers in FDCPA actions in state and federal courts throughout Kentucky. THIS IS AN ADVERTISEMENT, the information contained herein is for information purposes only and does not create an attorney-client relationship between Noah R. Friend Law Firm, PLLC and the reader.

Thursday, August 28, 2014

Wednesday, July 30, 2014

Study Says 35% of Americans Facing Collection Agencies

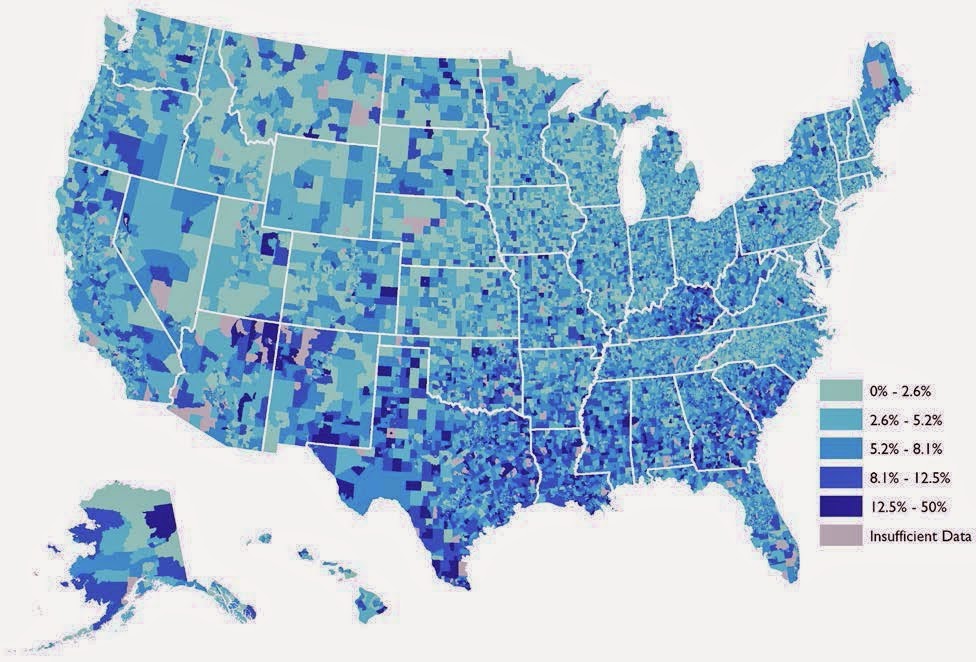

According to a recent study released by the Urban Institute, more than 35% of Americans have debts and unpaid bills that have been reported to collection agencies. These adults owe an average of $5,178.00. The full study can be found here.

The study reveals that the East South Central census region (which includes Kentucky) has the second-highest percentage of people with a debt in collections, with 41.3% of people having an account in collections.

Debt collectors do not just collect unpaid credit cards, but a wide-range of debts such as:

- MEDICAL

- cell phones

- utilities

- gym memberships

- book clubs

Every case is different, but many people facing debt collectors ultimately end up filing bankruptcy as a way to protect themselves, and to begin the process of rebuilding their credit.

Subscribe to:

Posts (Atom)